This article first appeared in the Jan/Feb 2016 issue of WGM.

Less than 12 months out from the opening of MGM’s second Macau property, MGM Cotai, WGM CEO Andrew W Scott sat down with Mr Grant Bowie – Chief Executive Officer & Executive Director of MGM China Holdings Limited – in a wide ranging interview discussing the current state of the market in Macau and what we can expect from MGM in the future.

Andrew W Scott: Thanks for taking some time out to talk with us, Grant. Let’s start by looking ahead to MGM Cotai which is scheduled to open in late 2016. What can you tell us about the property and in particular its non-gaming offerings?

Grant Bowie: I think it is recognizing that we have a smaller footprint – that it’s not just about what we put in. It’s almost like Cotai itself is the integrated destination. The notion that all the concessionaires must have one of each or a copy of each other doesn’t actually fit the bill. There are certain things we classified as mandatories like hotel, food and beverage – and even that is becoming a lot more dynamic in terms of the offer, the spend and the variety of product that people are expecting.

I think the critical point is: do we in Macau just want to be a copy of everywhere else or do we want to be bringing things that others haven’t seen? Because because we have a slightly smaller scale, we are focussed on being part of the creative process – creating some new food and beverage ideas and new entertainment concepts. From the entertainment perspective, we’re building an innovative theater which is new but also how do we actually build content that is responding to the rapidly changing nature of the Chinese visitor?

AWS: How do you go about maintaining flexibility in what you will offer while construction of the property is already well underway?

GB: The compromise of flexibility versus purpose is always a challenge but the one thing we’ve learnt is that Cotai to a degree and Macau absolutely is a place where the old guys in the industry can have a new lease of life. Because it is moving so rapidly and we’re being challenged so much, this is not a place to bring people that have never done it before.

The great and most exciting thing about Macau is that everything we’ve ever done anywhere else in the world may be relevant but it is not necessarily valid. I think we’ve all been testing those principles and it has become more and more complicated as time has gone on. We’ve seen that with the openings at Cotai. I still think it’s amazing in a pure gaming context that Cotai – given all the infrastructure and everything else that has gone in there – still only barely has 50 percent of the gaming revenues. That in itself throws up this notion that whatever the ultimate destination Macau is to become, we haven’t worked it out completely.

AWS: Do you think that’s a day tripper thing? If they come to Macau for a day they don’t want to lose another 40 minutes of their time by crossing the bridge?

GB: Potentially and I also think there is a historical context to that. For a lot of those predominantly gaming customers, the peninsula continues to be the centre of that activity. It has a unique characteristic about it which I think is really important. Everyone talks about the peninsula or Cotai but I think that is completely invalid. It is actually Macau and we need to focus more on Macau rather than one or the other.

That’s an attribute for us because we’ve got MGM 1.0 in Macau and MGM 2.0 in Cotai. We see that as being a Macau presence with different characteristics rather than being the peninsula and Cotai. We see the existing property as being the classic Macau property. It has a level of sophistication, a level of style and a level of presence which is the expectation of what a traditional gaming property is. I think we’ve done a really good job of bringing that style and presence to life. Cotai is more about the new age. One part of that is scale but the other is creative content. The demands for creative content in Cotai are much more severe and much more critical than in the peninsula where we are primarily casinos.

![[b]MGM Cotai is due to open in late 2016[/b]](http://www.wgm8.com/wp-content/uploads/2015/12/images_wgm_1039_grant-bowie-3.jpg)

AWS: So the peninsula in your opinion will continue to be more of a gaming destination while Cotai is where we will put all of our water slides and fun parks to make it more of a family destination?

GB: I don’t want to classify it as gaming and family. What I would classify it as is just the composition of leisure. It is an issue of how people allocate their time. I think when people come to the peninsula they probably allocate more time to gaming than they do in Cotai. That’s how I see it. But as a destination we need to sell Macau.

AWS: So how do we, Macau as a whole, sell Macau under the current conditions?

GB: I think we step back a little bit. When I first got here in 2003 we had no idea what was going to happen and frankly our expectations were much, much lower. Then Sands opened and we all got this “wow”. Then Wynn opened which created another set of characteristics and then progressively we kept on opening and reaping the opportunities that the market demand created for us. And while I think we all understood at the time that we needed to diversify, we didn’t actually do that. Even if we built bigger places, even if we had lots of shops and lots of retail, even if we built lots of MICE, it wouldn’t have meant that we mentally diversified or mentally developed. Therein lays the challenge.

The positive/negative we have is that we are still the largest gaming destination in the world but had we kept going with the sort of growth rates we had experienced I’m not sure we would have been sustainable over time because I think we would have become so gaming-centric and so mono-dimensional in terms of narrowing the customer segmentation that we would have got to the point where we were incapable of diversifying.

AWS: Even with all this talk about diversification, Macau is still in single digits when it comes to the percentage of revenue derived from non-gaming compared to gaming. How do we change that?

GB: The critical point is collaboration. I think the market strength in the past meant that we all operated independently and individually. The government, the community, the businesses of Macau and the gaming companies – we all were able to do our own thing. But, the first priority is that we have to act collaboratively in relation to Macau. That’s the greatest challenge we have to confront. I don’t think there is sufficient collaboration between the government, the business community – particularly the gaming operators but also the business community holistically – and the community. I think the strength of the Macau market probably made that worse.

AWS: We recently spoke with the President of the American Gaming Association, Geoff Freeman, about why Las Vegas succeeded while Atlantic City failed and he suggested the main reason Atlantic City has failed is because it took its early success for granted.

GB: Yes, success doesn’t actually build future success. It tends to mean we all focus on ourselves and that’s what I think we need to readdress. I think the infrastructure issues, the nature of the destination – diversity should actually bring us closer together. The closer we operate together consistently the stronger we will be.

AWS: What would the vehicle for that collaboration be? What would bring all the stakeholders together?

GB: Well I was hoping that adversity would be the mother of invention. There seems to be a sense of misunderstanding or a lack of appreciation that our competitors are outside Macau, not inside Macau. We’ve got to get our head around that. So adversity is the mother of invention – we are all having to learn what collaboration is all about and that it is not just about the gaming concessionaires, it’s about all the principal stakeholders. That means the government, the business community and the residential community. We’re all in this game together. I mean, I’m a member of the Macau community, you’re a member of the Macau community.

Some people may say that trying to improve the services of the taxi companies is a lost cause but if we don’t resolve that issue we all will suffer. Some people take on that initiative and we should be supporting it. Now, that type of collaboration is not organic to Macau. At present the differing groups are actually competing with each other and that is a fundamental flaw. When you talk about diversification, what that really means is it’s not about six, it’s about 600,000. We all need to diversify. And we can’t do it just because we’re told to do it because that will be a failure. If we do it because we believe in Macau, then that’s the sort of collaboration that will be sustainable. It’s a marathon, it’s not a sprint.

AWS: We’ve seen some failed efforts in the past at creating non-gaming amenities that were more lip service than anything else. What you’re saying is that it needs to be real – to be targeted towards Macau.

GB: That’s right and I come back to the fact that the transformation of the Chinese consumer is so fast – and they will miss out on the evolutionary phase that the Western consumer went through because China is importing the world. The trick is that China also wants to export to the world. It’s a really interesting position we’re in and Macau should be taking advantage of that. Because we’re small we should be flexible and we should be dynamic but we’re spending too much time second guessing each other rather than collaborating and realizing that this change in market conditions is the best thing that could have happened to Macau. It’s going to create the greatest opportunity we’re ever going to have to actually be able to respond to the changing nature of the Chinese consumer and therefore be price setters rather than just order takers.

AWS: Back to MGM Cotai. What are we going to see at this property that we’re not going to see elsewhere?

GB: The challenge I’ve got is that the nature of the product is the same as everyone else’s. The real question is how we execute it, so what we’re trying to do is focus on this whole process of entertainment and entertaining. It doesn’t mean we have to entertain the customer all the time. We want to create space and create opportunities people can actually engage with but feel they’re creating their own sense of entertainment. It’s not about us trying to out-scale any of our friends that live around us. We need Wynn, we need the Venetian and we need City of Dreams. I focus on those ones because they’re the closest cluster to us and we want people to move backwards and forwards between the properties. The product has to be what they want.

Retail for example, I think we’re all going back and saying that the luxury retail market has grown so fast and we need to go back and look at a different retail mix. I’m even challenged by my own team here where I’m saying, “Yes we want to be seen as a 5-star property but that’s not what people are buying now.” So what are the emerging retail brands? What are the emerging experiences? What we need in Cotai is still a work in progress because all the certainties that we had are basically going out the window.

AWS: You’ve got an interesting situation where all of these properties were originally planned years ago when times were booming and it’s obviously too late to slow down! Are we going to then get to a point in a few years’ time where there is actually an over-supply?

GB: The issue of trying to balance supply and demand has historically been impossible. It’s never been that precise. I think we’re going to have to start tapping into new markets because the supply is sufficient to allow us to actually do some research and development about what other market opportunities we have. And we really haven’t tapped in. We have been basically harvesting but now we’re going to have to be farmers and develop some markets. I’ve been saying the same thing over and over again having worked in other gaming destinations and jurisdictions around the world – quality beats quantity every day of the week.

Now, if you look back to six months ago it was all about quantity, whether it was too many visitors or the wrong people at the wrong time. In fairness to Mr Antunes [former Director of the Macau Government Tourist Office (MGTO) João Manuel Costa Antunes], he had been actively engaged in a wonderful destination research paper for Macau – which I don’t think has been used effectively – which kept on emphasizing the unique nature of Macau is its history, its scale and the new products that have been introduced. They understand it’s about the quality of the experience. And the quality of the experience is about the quality of the visitors. So for me, the sooner Macau gets to basically being a FIT (Flexible Independent Travel) market as a percentage of our business the better it is.

The sooner that we have direct relationships with our customers whereby they come to Macau and then buy one of our destinations the better – so they sleep somewhere but as in Las Vegas they eat in a different property, they go and see shows in a different property … they basically graze the whole of Macau. If they are in Cotai those visitors definitely come and see the old Macau and the parts of Macau which under the urban plan need to be revitalized and reinvented. That’s what I mean by collaboration. The different stakeholders need to invest in different elements. We know what we are good at. We can house the people, we can feed the people, we can entertain the people – but that doesn’t mean they don’t have time to have other experiences. That’s what we need to be actively pursuing.

AWS: Looking more at the gaming side of things, it’s no secret that junkets have been the hardest hit by the recent downturn. Do you foresee junkets still having a role to play in Macau’s future or could there be a day when they are no more?

GB: I think junkets provide an important part of the color of Macau but the reality is that the color needs to be relevant, so if the conditions and the relationships change then junkets need to change too. Do I think that junkets will continue to have a role in Macau? Yes I do and I hope they do because whether we like it or not, it’s a unique characteristic. It’s part of the cultural fabric but a lot of the local community – as we have seen as a result of the recent incident involving one junket – are directly invested in that piece of business. So it needs to transition and it needs to be relevant.

But I come back to my principal point which is that the destination and principal operators are rapidly evolving to develop direct relationships with their customers. If you have a direct relationship with the customer you actually know what they want. To that end, right or wrong, that’s what the foreign operators have brought to Macau.

I put it to you that we are already in our third phase of diversification in Macau and I think the six concessionaires have already made a big contribution to diversifying the market. The challenge is looking at whether each of the components of the market and their model is still valid. That’s what is being challenged with the junket market. I don’t think it’s a question of whether they survive, it’s a question of how much of the market will be sourced through that business – and consistent with the strategy that has been formulated it is going to be less than it is today.

AWS: At its highest the junket business contributed more than 70 percent of Macau’s gaming revenue. What percentage do you see that shrinking to?

GB: I would say the direct contribution of the junket business, not so much because it is getting smaller but because mass is growing, would be somewhere between 25 and 40 percent.

AWS: That’s a big difference from 70 percent.

GB: Yes but the fact of the matter is we haven’t built all of these facilities and we haven’t added all of this non-gaming activity, nor can we subsidize it, by bringing people in as junket. The economics and business model are hand in hand. Some things we learnt from Las Vegas – and we go back to your point about Atlantic City … I was working in Las Vegas when Atlantic City was growing. It was a very bleak time for Las Vegas because their whole world had imploded. So you’ve got to give credit to people like Steve Wynn in particular and other entrepreneurial type people who turned around and said, “You know what? We need to take advantage of our history and we need to broaden its appeal.” That’s when they really started to focus and say that Las Vegas could become a convention destination,so the city did invest in building a convention centre. But would Las Vegas have changed without Atlantic City? Absolutely not.

The interesting analogy there is that Atlantic City was a clear target for Las Vegas so they knew exactly what the threat was. Which begs the question – how come Las Vegas saw it and Atlantic City didn’t? It was because of the progressive development of regional gaming. There was no single target. And we need to be very careful in this destination that we don’t get put off by the fact that it’s not any single one of the destinations around us – Singapore, the Philippines, Vietnam, Cambodia or Korea. We can’t afford to underestimate the collective impact of those destinations.

When Edmund Ho made the decision to open up the concessions, he understood that he had a period of time to create critical mass. The way I always looked at the Macau consumer was that they were Atlantic City customers who wanted a Las Vegas experience. What we need to do is evolve the market such that we can develop people who are more leisure – Las Vegas – with gaming experience to increase the length of stay and frequency of stay.

We are not re-creating Las Vegas and we are not re-creating Atlantic City but there are some strategic things we can learn about the evolutionary cycles. Las Vegas survived because the Las Vegas people collaborated. The urgency and necessity to do that was very clear to them and I hope that we have the same strength of character to build the same collaboration in Macau.

|

THE EVOLUTION OF MACAU

|

||

|

||

|

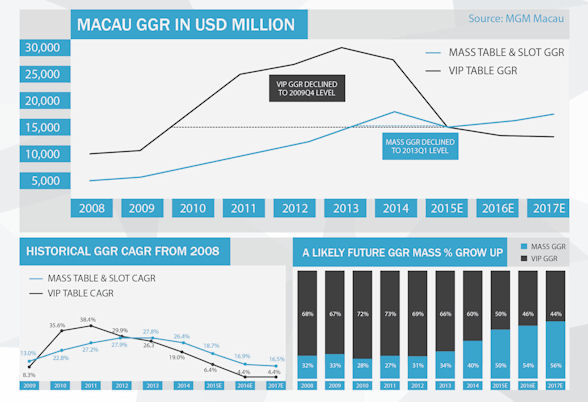

GRANT BOWIE: I think this graph is fascinating in understanding what is going on. Both at a Macau level and a China level, it was inevitable what was about to happen and as we can see, what has happened with the mass is that it has continued to grow. I learnt a very valuable lesson when I first came to Macau – a guy who was in a state owned enterprise told me how to survive in China. One, never embarrass the party and two, never get so big that you must be embarrassing the party. And I think we got too big and we embarrassed everybody. The difference is that in a controlled economy, when they control it, they control it. Now I think for a long time people tried to work their way around it. We had some indicators and some blips but then it got to the point. But the strength of it to me is that as long as the mass curve keeps growing, we’re heading in the right direction. It’s telling me about diversification – and the truth is we’ve already diversified. We went from one operator to six. We also understood that you can’t diversify your non-gaming products until you diversify your gaming products because junket customers don’t use non-gaming assets, so it was critical that we started moving mass. And now that mass has started moving, now we need to start asking, “How do we increase the length of stay so that the mass and the non-gaming fit together?”

|

||

AWS: But that has traditionally been the problem here – Macau has never had a clear targeted threat. So how do you get everyone to collaborate and recognize that they still need to act and progress?

GB: For starters, we have to give the Chinese government confidence that we clearly understand the parameters in which we’re operating. We don’t deny it. We understand the objective. The problem in the past was that business was so good that the necessity to diversify wasn’t clear and present. The necessity to diversify right now is clear and present – not because we are in trouble, we’re not, but if we fail to heed the message it will not improve.

AWS: What percentage of non-gaming can we achieve here in Macau in terms of revenue?

GB: I’ll say 45 percent. I’ll never go under 50 percent for gaming because we have some limitations on the mass we can create. One of the other reasons is that we have to understand that if we are actually successful in diversifying, there is going to be a plethora of activities within China which is going to add value to our non-gaming. So I think we need to be clear and we need to share the message even with the Central Government that the measuring of the diversification which may have an epicentre in Macau has to also be measured by how successful the non-gaming has evolved and developed in Hengqing, in Zhuhai and the band stretching back to Xiangzhou.

![[b]Imperial Court at MGM[/b]](http://www.wgm8.com/wp-content/uploads/2015/12/images_wgm_1039_grant-bowie-8.jpg)

What we need to understand is that we’re very proud citizens of Macau but we are also part of China. In some ways it’s actually easier for outside people to see that. It may actually be more challenging for Macau people to appreciate it. And all the gaming companies are fundamentally Macau people, whether it’s because 75 to 80 percent of our people are Macau citizens or because nearly 100 percent of our assets and built and will always reside in Macau. The fact that we’re dependent on the Macau government and the regulatory framework of the Macau government to be successful – that fundamentally means we are Macau. But at the same time we understand that if we don’t provide a broader catalyst for the development of non-gaming assets, because we don’t have enough land yet, then we will not be successful going forward.

AWS: Does MGM see itself as a Chinese company or as a Western company?

GB: We see ourselves as a Macau Chinese company, but I fully understand that in China we will be seen as Western. That’s our strength. As MGM, who is committed to China, we want to bring the world to China. As a China company who understands what it’s like to live in China, we want to take China to the world. So we see that relationship as being really, really positive.

![[b]Square Eight[/b]](http://www.wgm8.com/wp-content/uploads/2015/12/images_wgm_1039_grant-bowie-9.jpg)

We’ll always be seen positively as a friend of China and a friend of Macau but I understand that when people want to be critical we will always be seen as a foreigner. That just means we have to continue to improve ourselves, so it’s not a label I consider overly important.

AWS: WGM has run focus groups in the past where we’ve asked people to identify each of Macau’s big properties or concessionaires with a word. The Venetian always gets “big”, SJM always gets “Chinese” and Wynn always gets “luxurious” but when we get to MGM people tend to be stumped. What’s your view?

GB: We’re less about our property than we are about the experience. And I know that’s a strange perspective to take but it’s something we’ve built over time. Now, if we weren’t doing things that our customers appreciated, simplistically we wouldn’t be able to drive the market share that we’ve been able to obtain which is more than our fair share. We’re less about the parts and more about the whole.

I admit that we’re difficult to pigeon hole but I see that as a strength because as we are evolving with our next property and some of our other activities, we are going to continue to transform ourselves around this whole notion of what leisure and entertainment is – that people feel comfortable being in our properties and enjoy the quality of the experience. I don’t necessarily see it as bad that people can’t give a one word answer, as long as they try and connect because what we are very good at is building relationships with our customers. We are not a family-oriented property but families feel very comfortable here, so it’s not about the one word or the one statement, it’s about over time building consistency and credibility. I see it more like building a retail brand that take time to grow.

![[b]Rossio[/b]](http://www.wgm8.com/wp-content/uploads/2015/12/images_wgm_1039_grant-bowie-10.jpg)

But we need to be consistent in providing quality. And we don’t need to be everybody’s first choice, but I certainly want to be everybody’s second choice. I want people to be comfortable at MGM. If you don’t know anywhere else to go, come to MGM because there is always something happening. Look at Oktoberfest as an example. It is now an iconic event of Macau and we created it. We persisted. And we understood that the nature of the local consumer and Oktoberfest were not exactly the same. We have a lot of families come to Oktoberfest here – they don’t go in Munich. So we’ve created our own version of Oktoberfest. The food works – the pork knuckle and the sauerkraut. We tweak it to make it work for the crowd we have. And once we connect with those customers, they stick with us.

AWS: The two new Cotai properties to have opened so far have both been given fewer new to market gaming tables than they had requested with Galaxy receiving 150 and Studio City 250. With that in mind, how many tables do you realistically expect to receive when MGM Cotai opens?

GB: We would clearly like as many tables as we can get, however whatever they give us we will make work. But we’re also mindful that we need balance between the tables to support the rest of the resort as well. I think we’ve demonstrated at MGM that we’re able to make the best of whatever we’ve got. We’re good at the way we manage our resources.

AWS: Will you consider moving tables from the current property to the new one?

GB: The answer to that would be, “If it made sense.” Part of that answer is that we want to add diversified assets here [on the Macau peninsula property] as well. So to a degree we need to free up space to do some other things here we believe would be attractive.

AWS: For example? What else would you like to do here at MGM?

GB: We’d like to put more food and beverage. When I first came to Macau, when you built a hotel you put in a Cantonese restaurant, a Western-style coffee shop and you probably put in a gourmet restaurant of some description – primarily Italian. If you were very adventurous, the next option would be a Shanghainese restaurant. But the Chinese consumer has transformed. Our own research tells us there are 120 to 130 different ethnic cuisines where the number of people who consume that cuisine exceeds 20 to 25 million people.

So now we sit back and say, “What do we do?” Well, we can either keep doing individual restaurants or we create fusion options. We create different dining experiences, some of which are strictly ethnically driven but others which are the taste and flavors of different places that bring the customer back. There is no question the world is going through a huge culinary and gastronomic explosion and China has always led the pack. Dining has always been a critical component of hospitality and leisure. So as in Macau, we are drawing more and more people from different locations in China and we need to be able to accommodate more and more cuisines.

AWS: The labor shortage in Macau has been an issue for a very long time. Long term, how do you feel about the problem and do we eventually need to start getting in more people from outside?

GB: The government has been very clear and very consistent in its message in the belief that the best jobs were always going to be the gaming jobs. The problem is that, as you diversify, that may not necessarily be true. That’s now one of the great challenges – how do you diversify the employment base of Macau when even the government didn’t believe that would ever happen? We’ve sucked hundreds of people out of the diversified industries of Macau – some of which were running out of steam such as the garment industry or some of the manufacturing industries – but they’ve all been sucked into gaming.

AWS: Do you want all of your people, or such a large percentage, all working in the same industry?

GB: No but it is part of the evolutionary process. The government has made a very clear commitment to its people, as it should, that they should be the major beneficiaries of whatever the major economic development is because they’re the ones that also have to live with the change. So I think that’s valid. I think those who are in gaming today we just accept. The bigger issue is the younger people coming through the system now – we need to get them to understand that the opportunities in the future of Macau will come from the diversification. Gaming is not the be all and end all.

We also need to spend time with our gaming people creating opportunities for them to, in their minds, take the risk to try something else. That’s generational and that will take time. People can quite easily make the issue political but we need over time to understand what is in the best interests of Macau. Does it make sense that people don’t want to be a dealer but because it’s easy and available they don’t pursue their own personal passions?

So it’s about steps and the first thing we need to do is have the conversation about what the opportunities are. There are people who will always be in gaming but those graduating from school or university must have a better perception of the choices available to them.