This article first appeared in the Sep/Oct 2014 issue of World Gaming magazine.

There is more than one way to gamble in Macau. While many of our readers have had their fair share of success on the baccarat, sic-bo and poker tables, others have made a killing playing Macau gaming stocks over the last few years. And you don’t even need to come to Macau to do it.

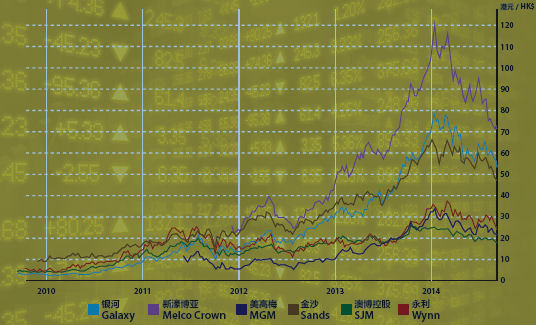

Chinese people, and especially those from Hong Kong, love to buy and sell stocks. When taxi drivers and nightclub “dancers” are eagerly discussing the stock market you know its influence has found its way to every corner of society. And those who were wise (or lucky) enough to buy Macau gaming stocks in 2010, 2011, 2012 and 2013 have ridden an incredible wave of gold. Consider this graph:

The average share price growth of the six Macau gaming stocks over the four-year period was a staggering 151 percent per annum. That’s per annum, not for the whole four years. Over the entire four-year period the stock grew about six-fold! No wonder so many people have been walking around with smiles on their faces – these are the sorts of gains more usually made by international arms dealers and Colombian drug cartels, not legitimate listed companies.

But no matter how good a party is, it has to end at some point, and this party was no exception. Whilst SJM peaked on October 21 last year at HK$28.00, it was really in January when everything starting going pear-shaped. January is the coldest month of the year in Macau and it certainly turned the casino stocks to ice. They’ve been in the freezer ever since. Both Galaxy and MGM peaked on January 20 (at HK$84.50 and HK$36.15 respectively), Melco Crown peaked two days later at HK$126.80 and Sands peaked on February 28 at HK$68.00. Wynn managed to hold on a bit longer, peaking at HK$38.80 on March 5 before beginning its plunge in value.

This year has been nothing but doom and gloom for the six Macau gaming stocks, with the average peak-to-trough fall across the board around 30 percent. Even if we ignore peaks and troughs and look at the first half of 2014 as an arbitrary six-month period, the industry-wide share price fall has been 13 percent. And the stocks have continued to fall since then.

Take GEG stock for example. At the beginning of 2010 it was a steal at a mere HK$3.20. That’s loose change. Someone then flicked a switch and it went on a four-year meteoric rise. Like a rocket blasting off into outer space there was only one direction – up! Its peak of HK$84.50 – over 25 times its price of just four years earlier – propelled Chairman Lui Che Woo to the title of “Asia’s second richest man”. But today it is languishing in the mid-50s, some 35 percent off the peak.

So the big question on everyone’s lips is this: Why?

What happened? Everything was going so well and then suddenly – busto! Just like a gambler on a hot streak whose “juju” suddenly turns ice cold.

We’ve spent a lot of time here at the WGM bunker tossing around ideas on what caused the collapse. Of course, we also listened to the thoughts of other commentators and the bank analysts too. We particularly like the analysis of Karen Tang, Head of Asia Gaming and Lodging at Deutsche Bank Research. Tang puts the fall down to four specific reasons.

Firstly, she says that mass table yields have finally peaked around HK$100,000 per table per day after four years of steady growth from around HK$35,000 per table per day. In fact the win per table per day in the second quarter of 2014 was 3 percent down on the first quarter. It’s true that table minimums steadily grew over the 2010 to 2014 period leading to greater action on the tables. But in recent years we’ve seen the rise of hybrid live dealer technology in Macau – where dozens or even hundreds of players bet at electronic terminals on the results of real hands dealt by real dealers at a handful of tables that the players watch via video link. The expansion of these live dealer tables has filled the “lower mass grind” gap caused by rising table minimums in normal squeeze games. But this dynamic is largely played out now – table minimums are now very high and we don’t see them going much higher in the next year or two. This means the properties now have to focus more on growing the number of players rather than being able to grow both the number of players and the amount they bet.

Tang’s second stated cause for the stock plunge relates to labor costs. She points out that labor is up from 6.8 percent of gross gaming revenue (GGR) in the second half of 2013 to 7.4 percent in the first half of this year. But there is so much more to this story than numbers on paper. In the last few months gaming workers have been openly protesting on the streets, calling for what they call a “fairer share” of the spoils of gaming. Given the Macau government’s labor policies restricting the use of foreign workers and Macau’s incredibly low unemployment rate of 1.7 percent, there really is only one way labor costs can go – up. This is despite significant increases in salaries and working conditions in recent years. The current battle between the casino owners and the casino workers is something we’ll be looking at more closely in an upcoming issue of WGM.

The third factor is comps. As the players mature and competition between the six concessionaires intensifies, the properties have to be more generous with their promotions and rewards. Tang points out that comps for the first half of 2014 were 3.6 percent of GGR compared to 3.4 percent of GGR just six months earlier. That may only be 0.2 percent more of GGR but that does represent a six percent jump in comp value to somewhere around HK$13 billion a year in rewards paid out to players. Tang says, “With new supply in 2015-17, we expect comps to rise further as competitions on premium mass intensify.” We agree with her.

But perhaps the biggest factor is the last one that Tang raises – government delays in providing certain construction permits which in turn is delaying the opening of the planned new casinos in Cotai.

Each of the six Macau casino companies has a new property slated to open within the next three years: GEG has Galaxy phase II, SCL has Parisian, Melco Crown has Macao Studio City, SJM has Lisboa Palace, Wynn has Wynn Palace and MGM has MGM Cotai. Collectively these six new properties have come to be known as Cotai 2.0 and it is expected that the first of these, Galaxy Phase II, will be ready to open early next year with the last, probably Lisboa Palace, expected to open in 2017.

Back in June two workers were injured at the Parisian construction site leading to a construction embargo pending the issue of permits by the Macau government. This wasn’t just a 24 or 48-hour thing – work on the project has been stalled for months.

We’ve heard this kind of story before. Macau being Macau, don’t be surprised if some, many or even all of the new properties are delayed for a greater or lesser period of time – for any number of reasons. Why does this affect the share price? Because the expected profits from the new properties are already factored in to the stock. If it becomes apparent these profits will not eventuate until a date later than expected, that value needs to be rolled back from the share price.

We may have also seen the end to the massive Macau gaming revenue growth figures we’ve become accustomed to seeing year after year. So far in 2014 the growth in revenue from the mass market is only half what it was the year before. There are a number of reasons put forth for this including harder-to-get visas from China, a “crackdown” on the use of Union Pay cards in Macau (or at least the perception of such a crackdown) and even simply the fact that 2014 presents nothing new in Macau until the excitement returns in 2015 with the start of the opening of the new properties. As Tang concludes in her report on the state of the industry, “All these (trends) reflect intensifying competition amid slowing demand.”

So what’s the long-term prognosis for the stock prices of Macau’s six gaming companies? While there is a lot of doom and gloom in the air right now, the fundamentals of the industry as a whole are still very sound. China’s massive population base is on Macau’s doorstep and the middle class of China is expected to rise from around 250 million to perhaps 750 million (depending on exactly how you define middle class) in the next 10 years. The owners of all that wealth will be looking for somewhere to take a bit of rest and relaxation and Macau and Hong Kong currently account for around two-thirds of all outbound Chinese tourism. It doesn’t take a genius to work out Macau will be a long-run beneficiary, especially given the massive transportation infrastructure improvements currently underway such as the significant expansion of China’s Very Fast Train network and the building of the monstrous Hong Kong-Zhuhai-Macau bridge.

But this is only half the story – while the industry as a whole may be very robust in the longer term, the competition between the six players is hotting up. The six are maturing, and winners and losers are starting to emerge. No longer is it a case of “buy all six stocks, wait and collect your profit”. The strategic decisions each company makes over the next year or two may well determine how the pie is carved up between them for the next decade or even more.

It pays to remember that discretionary leisure travel is one of the first things to suffer in bad times, so while the fundamentals are good the gaming and tourism industry will always be subject to volatility along the way. Our advice is to not rush in to buy just yet – we may well see the stocks tank quite a bit more or perhaps bounce along the bottom for some time before the sunny days are here once again.